CFSS Transition

Make your own decision about what will work best for you

Before getting into the details, here’s the most important thing to know:

YOU DON’T NEED TO MAKE ANY DECISIONS UNTIL AFTER YOUR ANNUAL RE-ASSESSMENT.

If someone is pressuring you to make changes to your care or staff before your annual assessment, they may be doing so from their own self-interest. Before you make any changes to your home care, you will have an opportunity to discuss your options and ask about the impacts of your decision with someone (part of the new CFSS program called Consultation Services) whose job it is to provide accurate, unbiased information about your options.

Join an Info Session

SEIU is hosting informational zoom sessions for Clients, Responsible Parties, and Caregivers to ask questions and support each other through this transition together. You can register for an info session here: https://seiu.mn/cfssinfo

What is the Process?

PCA Clients should expect these steps as you transition to CFSS this year.

Step 1: PCA Clients have an annual re-assessment, as usual. Based on your assessment, your current services will continue for a period of up to six months while you explore your options in CFSS. Don’t wait to move to step two, though. You will benefit from having more time to explore your new options and make a choice that works best for you.

Step 2: After re-assessment, you will need to set up a meeting with a Consultation Services Provider. There are a number of them to choose from, and you can find a list of providers here: https://mn.gov/dhs/people-we-serve/people-with-disabilities/services/home-community/programs-and-services/cfss-consultation-services.jsp

Step 3: At the first meeting with Consultation Services you should have your CFSS options explained to you in detail, using your assessment results. You should be able to answer these questions after your first meeting:

- If I choose the Budget Model, how much money would be in my annual budget? In addition to care hours, how else can I spend that money?

- What are the different minimum wages in the Budget Model and Agency Model?

- Could my caregivers’ wages change based on which model I choose? How will I know what my caregivers’ wages will be in each model?

- Which model is covered by the Home Care Workers Union (SEIU)?

Step 4: Choose either CFSS Budget Model or CFSS Agency Model, and inform your Consultation Services Provider of your choice.

- If you choose CFSS Budget Model, you will hire an FMS Provider to help manage your budget, and move to step 5 to build your budget and make decisions about how to use the funding for your care.

- If you choose CFSS Agency Model, you will hire a CFSS Agency to provide staff. Your current caregivers will need to sign a new agreement with the agency, and may have their wages changed.

Step 5 (CFSS Budget Model only): Work with your Consultation Services Provider to build your budget for the year. This includes setting wages for your caregivers, deciding how many hours of care to plan for, and reviewing new ways you can use the funding provided by the state.

What to Watch Out For

If your PCA agency or anyone else tries to change your program or influence your choice of a CFSS service model, make sure you are making informed decisions about what’s best for you. Ask questions. You can also reach out to SEIU at EMAIL to connect with other clients and workers who are dealing with the same sorts of misinformation.

Things to watch out for:

Be careful if your agency or anyone else tries to influence your decision between the CFSS Budget Model or CFSS Agency Model

Be careful of phrases such as,

“Budgets are complicated and overwhelming, like running a small business…”

- The flexibility of the CFSS Budget Model does mean more responsibility, but an FMS provider will help you with payroll, paperwork, taxes, etc. A Budget Model Client/RP is responsible for staffing and creating a yearly budget plan, and there are supports in place to help you set your budget to best meet your needs.*

“The Budget Model will expose you to legal risk…”

- The FMS provider ensures compliance with all state and federal laws. There are already two budget-model programs in MN (CDCS and CSG) with thousands of participants, and they have not led to Clients/RPs having legal problems.*

“Changes are coming to the PCA program, but nothing will change for you if you just stick with us as your agency”

- The agency and budget models of CFSS are different in several important ways, not the least of which is the guaranteed wage and benefit standards that come with the union contract in the budget model. Once you have a chance to learn about both models through conversations with a Consultation Services provider, you will be the one to decide which model is right for you.*

“We need to update your paperwork, so just sign and send back to us…”

- Make sure that any paperwork you are asked to sign doesn’t make changes to your services.*

“The state doesn’t pay us for PTO, Holidays, etc…”

- The state reimbursement rate is meant to cover wages, benefits, and overhead. There is not supposed to be a separate reimbursement rate for benefits.*

“DHS is making us…”

- Any required program changes will be communicated during your yearly assessment process, not just via your current PCA agency.*

Be cautious if a home care agency offers you or your workers a financial incentive (cash bonus, wage increase, etc) to make a program change. This is not allowed, but some agencies have tried it.

Why the misinformation?

CFSS will offer Clients/RPs two options for care. Only one of these options, the Agency model, will use PCA/CFSS agencies. In the Budget model of CFSS, there will be a Fiscal Management Service (FMS) to support clients with payroll, paperwork, taxes, etc. Every client currently in the PCA program who chooses the Budget model of CFSS will be leaving their PCA agency – meaning a decline in income for the agency. While most PCA agencies will handle this transition responsibly, we have already seen some agencies try to confuse or scare their Clients/RPs about the CFSS Budget model.

Information for Clients/Responsible Parties (RPs)/Participant Representatives

What’s Changing?

- Minnesota is in the process of replacing the old PCA program with a new and improved program, called CFSS

- Starting in October 2024, all re-assessments for Clients/RPs who currently use PCA Choice, traditional PCA, or the Consumer Support Grant (CSG) will include a meeting with a Consultation Services Provider, who will explain your options and answer your questions

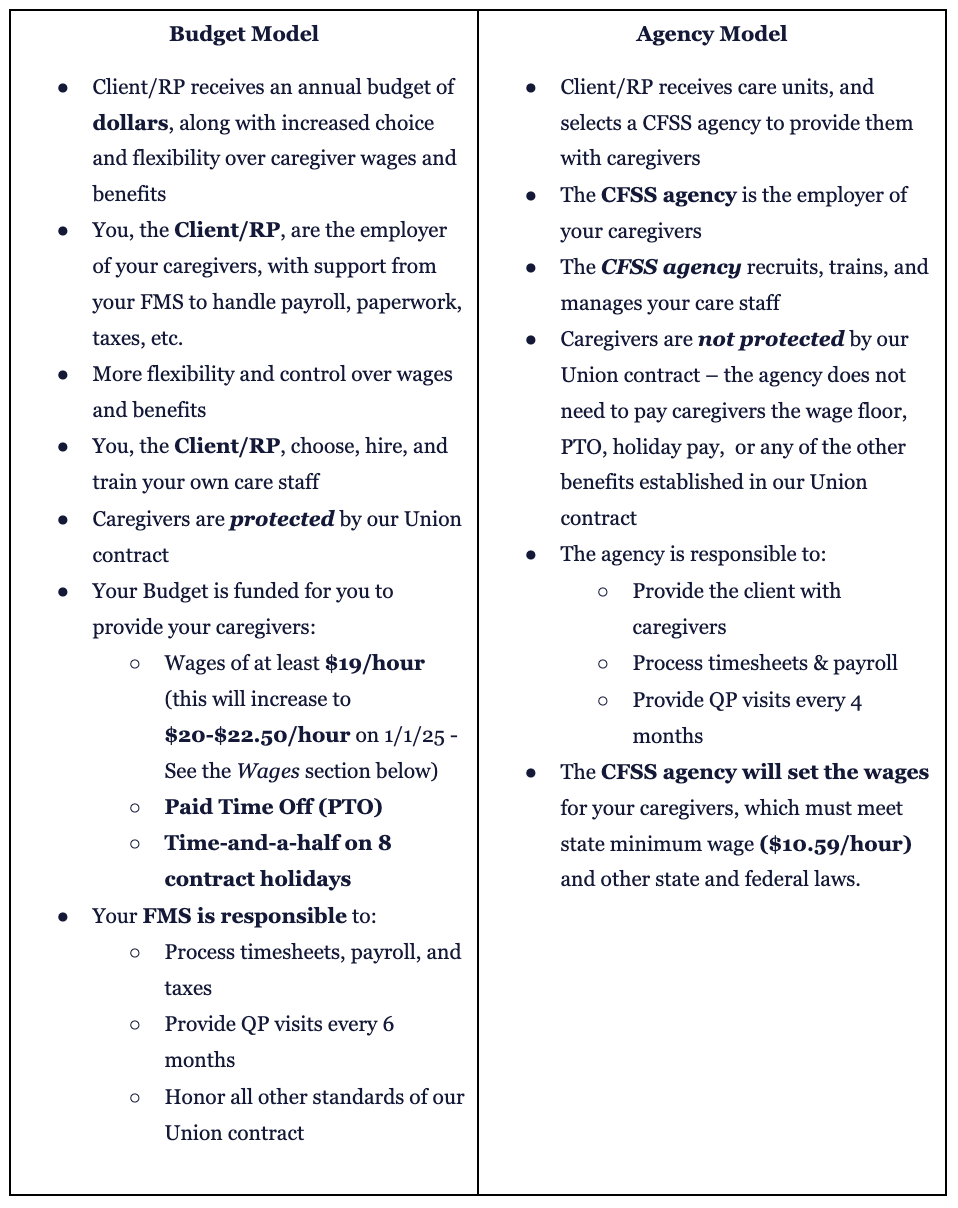

- As the Client/RP, you will choose between two available CFSS models: Budget Model and Agency Model

- The model you choose as the Client/RP will determine whether your caregivers are protected by our Union contract - this is often referred to as being “in the Bargaining Unit”

Who Decides?

You are the only one who can decide which home care model is best for your care needs and your care staff. Many clients and responsible parties feel confused about the options available to them, or the impacts of this decision on their caregivers. The information on this page is meant to help you to make an informed decision. We know that program changes can be incredibly stressful. We’ll do our best to give you useful information as clearly as possible.

CFSS Budget Model vs. CFSS Agency Model

What’s the Difference?

There are many differences between these options, and no one but you can decide which option best meets your needs. Your Consultation Services Provider will be best suited to explain the difference between the models when it comes to your access to goods and services, so we’ll focus here on how each model will impact your care staff.

Choosing an FMS Provider

There are several FMS providers to choose from in Minnesota. Many of them are based in Minnesota and only operate here, while others operate in other states as well. Each FMS is listed, along with their fees, here.

Information for Workers

What does the CFSS transition mean for me?

This transition means that the person (or people) you care for will be making decisions about their care that will directly impact your wages and benefits. Ultimately, it’s your Client’s decision which program best meets their care needs. These decisions should be based solely on what is best for the Client and their access to care, not on what’s best for the home care agency and also not just on what’s best for us as the caregivers.

You can discuss with your client/RP how their choice of model will impact your wages, benefits, access to training, and worker protections, and make sure they fully understand the impact of the change they’re being asked to make. If they’re open to it, you can help them find alternative options that can allow everyone’s needs to be met (see the resources in the Client/RP section above). And you can encourage them to talk through the pros and cons of the Budget and Agency models with the Consultation Services provider they will get at their annual assessment.

Just as the Client decides which CFSS model to use, you get to decide where to invest your time and labor. Once your Client has gone through the assessment process and selected their CFSS model, you may experience big changes in your wages and benefits as a result. As caregivers, many of us have gotten used to self-sacrifice - some even pride themselves on it. But that is what has allowed our work to be devalued and exploited for so long, and in the end it hurts us, our families, and the people we care for. There are so many people who desperately need care. People across the state are on the verge of being forced into an institution and losing their ability to live in their homes and communities, due to not being able to find home care workers. You can have a career as a home care worker and demand a living wage for the work you do. If you’re looking for options, please reach out to us here: Discuss PCA Program Change Questions

What are the benefits for caregivers in the CFSS Budget Model?

The wages and benefits listed below, which are part of the current union contract between SEIU Healthcare MN/IA and the State of Minnesota, are only guaranteed to caregivers in the PCA Choice, CDCS (Consumer Directed Community Supports), CSG (Consumer Support Grant), and CFSS Budget Model programs. Home care workers whose Clients are in the traditional PCA program or CFSS Agency Model are not guaranteed these wages and benefits, as the wages and benefits in traditional PCA and CFSS Agency Model are decided by the agency.

Wages

January 1, 2024

- Union wages increase to AT LEAST $19/hour

- Enhanced Rate PCAs should see wages increase to at least $20.42/hour (unless you’ve discussed establishing other enhanced benefits with your agency/FMS or Client)

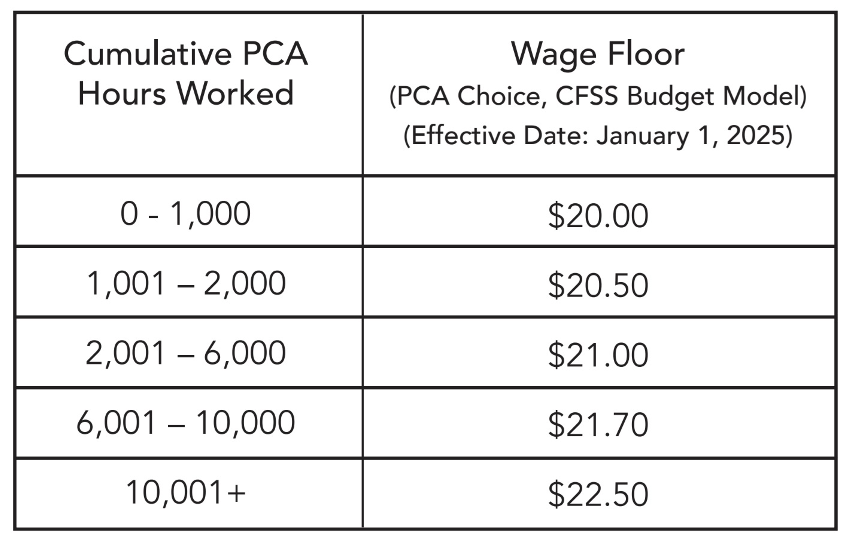

January 1, 2025

- Union wages for new workers increase to AT LEAST $20/hour

- Wages for existing workers in PCA Choice and the CFSS Budget Model are based on the number of PCA hours worked since July 1, 2017, as shown on the wage scale below

- As you work, your wages will increase as you meet each new step on the wage scale

- Your client will receive additional funds from the state to be able to pay the experience-based wage in the chart above. They will not have to reduce worker hours or other expenses in order to pay the higher wages earned by experienced caregivers.

- Enhanced Rate PCAs in PCA Choice and the CFSS Budget Model should see wages roughly 7.5% above the listed wage (unless you’ve discussed establishing other enhanced benefits with your agency/FMS or Client)

Paid Time Off (PTO)

- Union workers earn at least 1 hour of PTO for every 30 hours worked, and may carry over up to 80 hours of PTO from fiscal year to fiscal year (July 1st - June 30th)

Holiday Pay

Union workers earn time-and-a-half for all hours worked on these days:

- New Years Day

- Rev. Dr. Martin Luther King Jr. Day

- Memorial Day

- Juneteenth

- Independence Day

- Labor Day

- Veterans Day

- Thanksgiving

Training & Stipends

We've got info and links to all the stipends here.

$500 Training Stipend + Free Classes & CPR Certification

- Union workers have access to free training, and a $500 stipend for completion once every two years. This includes the same training required to qualify for the Enhanced Rate.

- Traditional PCAs must pay out of pocket for the same training

$1,000 Recruitment & Retention Bonus

- Workers are eligible for a $1,000 bonus when they’ve worked in the SEIU bargaining unit for at least six (6) months

$200 Electronic Visit Verification Stipend

- Union workers are eligible for a $200 stipend to offset any costs of meeting new EVV requirements

Definitions

CFSS: Community First Services and Solutions (CFSS) is a new home care program in Minnesota as of October 2024. CFSS will gradually replace the current PCA program.

CSG: Consumer Support Grant (CSG) is a legacy budget model program which offers more people the opportunity for self-direction but does not qualify for federal matching funds. CSG will be phased out in 2025 as part of the transition to the new CFSS program.

FMS: Financial Management Service (FMS) providers support budget-model Clients/Responsible Parties with their employer responsibilities such as payroll, documentation, taxes, etc.

RP: A Responsible Party (RP) is someone who directs care on behalf of a Client who is assessed as unable to direct their own care. In CFSS, this role is called the Participant’s Representative.

PCA: Personal Care Assistance (PCA) is a legacy home care program which will be phased out in 2025. Both components of the PCA program – Traditional PCA and PCA Choice – will be replaced by the new CFSS program.

Links to more info: